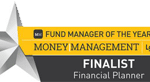

The Federal Treasurer Josh Frydenberg, delivered the 2020 Federal Budget on 6 October 2020. As anticipated, the budget included bringing forward personal income tax cuts to deliver tax relief to low and middle income earners for the 2020-21 income year of up to $2,745 for individuals and up to $5,490 for dual income families.

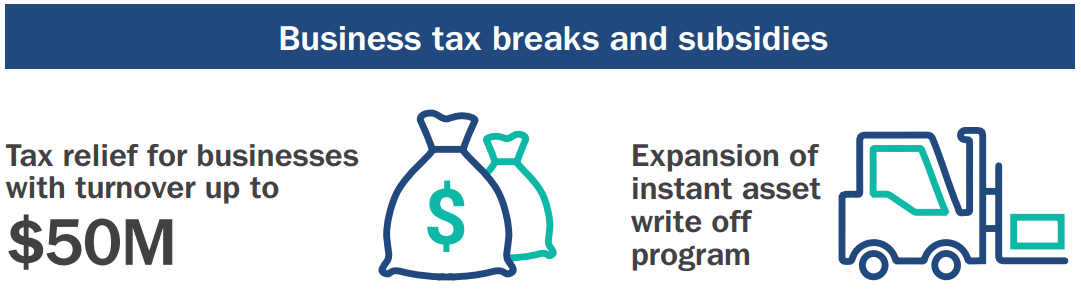

The Treasurer also announced a range of taxation benefits for small and medium businesses, intended to stimulate the business sector leading to jobs growth.

Please see our brief summary below and if you have any questions then of course we’re here to help!

Personal income tax

- Immediate tax relief: ’Stage two’ personal income tax cuts will be brought forward two years, and backdated to 1 July 2020.

- Raised tax brackets: The upper threshold of the 19% tax bracket will rise from $37,000 to $45,000 and the upper threshold of the 32.5% tax bracket will rise from $90,000 to $120,000. This will be worth the equivalent of $41 a week to those earning between $50,000 and $90,000 a year, and about $49 a week to those earning more than $120,000 a year.

- Boost for workers on lower incomes: Workers on lower incomes will gain from an extension of the Low and Middle Income Tax Offset for a further 12 months until 30 June 2021, and increase in the Low Income Tax Offset.

Support for pensioners, low income earners, welfare recipients and job-seekers

- Two cash payments: Aged pensioners, carers, disability support and concession cardholders will receive two $250 payments. The payments will be made progressively from 30 November 2020 and early 2021.

- Incentives for employers to hire: A JobMaker Hiring Credit will be paid for a year to businesses who hire an eligible unemployed worker aged 16 to 35. The rate will be $200 a week for people under 30 and $100 a week for people between 30 and 35, and they must work at least 20 hours a week. The JobMaker Hiring Credit is aimed at filling the gap when the JobKeeper scheme ends next March.

- Support to businesses employing apprentices and trainees: A wage subsidy will reimburse eligible businesses up to 50% of a new apprentice or trainee’s wages. Subsidies are capped at $7,000 per quarter, per eligible apprentice or trainee, capped at 100,000 places

Superannuation Reform

- the Australian Taxation Office will develop systems so that new employees will be able to select a superannuation product from a table of MySuper products through the YourSuper portal

- an existing superannuation account will be ‘stapled’ to a member to avoid the creation of a new account when that person changes their employment. Future enhancements will enable payroll software developers to build systems to simplify the process of selecting a superannuation product for both employees and employers through automated provision of information to employers

- from July 2021 the Australian Prudential Regulation Authority will conduct benchmarking tests on the net investment performance of MySuper products, with products that have underperformed over two consecutive annual tests prohibited from receiving new members until a further annual test that shows they are no longer underperforming.

Business tax changes

- Immediate tax write-off: Businesses with annual turnover of up to $5 billion can write off the full cost of eligible capital assets acquired from 7 October 2020 and first used or installed for use by 30 June 2022.

- Loss carry-back: Companies with aggregated annual turnover of less than $5 billion will be able to apply tax losses from the 2019-20, 2020-21 and 2021-22 income years against previously taxed profits from the 2018-19 and later tax years by claiming a refundable tax offset in the loss year.

- Specific changes for small business: Small businesses with a turnover of up to $50 million will be able to access up to 10 tax breaks, with fringe benefits tax scrapped on car parking, phones or laptops, simpler trading stock rules and easier PAYG instalments.

First home buyers

- Purchase cap lifted: Up to 10,000 more first home buyers will be able to get a loan to build a new home or buy a newly built home with a deposit of as little as 5%. The purchase cap will also be lifted and varies depending on the State and regional area.

How Endorphin Wealth Management can help

We’re focused on advice, rather than product sales.

Here at Endorphin, we are not licensed by the big banks and financial institutions, so the advice we provide is always in our client’s best interests. We have the advantage of being able to access a range of products from different providers that can be tailored to our client’s needs. We also utilise subscriptions to four of the top research providers in Australia to cross reference our research and recommendations.

Comprehensive analytics and research

We invest a great deal of time and effort researching the best wealth management strategies for our clients and have developed a number of systems to manage and track the marketplace.

The investment landscape always evolves and it is more important than ever to consider your investments and superannuation funds carefully. We pride ourselves on being experts in researching opportunities, investments and strategies that fit in with your retirement goals and to create a happy and carefree retirement. We want all of our clients to get on with enjoying their life rather than worrying about money.

For an obligation free conversation about your financial future, please contact us on 03 9190 8964 or at [email protected]