If you were given a choice to keep the tax rate you’re paying right now or to lower your tax rate by 40%, it’s very likely that you would choose the latter. After all, who likes paying more tax than they need to?

Realistically, the ATO would never help you find ways to pay less tax, so this situation seems very unlikely to happen. Using a ‘bucket company’ is a strategy which you could look to adopt.

Our experienced advisors here at Endorphin Wealth can help you explore this strategy further.

What is a Bucket Company?

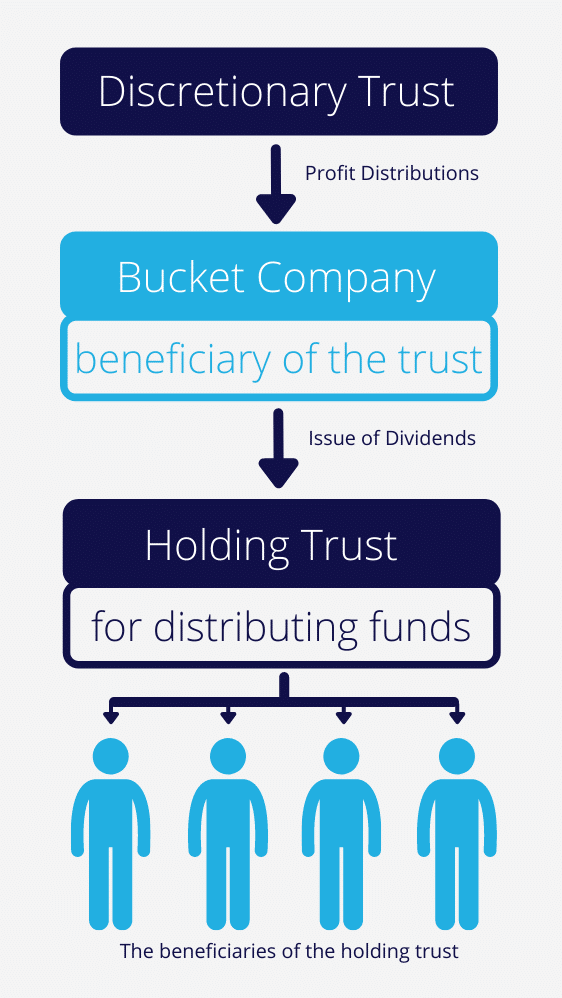

A bucket company, also known as a corporate beneficiary, is a company that receives a distribution of wealth from a discretionary trust. The beneficiary who sits below the trust and collects the money poured into it is known as the ‘bucket’.

An individual’s tax rate can be as high as 47% (including Medicare levy). In contrast, the recent base company tax rate has now been reduced to 25%* this year. Obviously, the difference of 22% of is better in your pocket than in the ATO’s. But how can an individual claim this tax benefit?

*For companies with an aggregated turnover of less than $50m.

How to set one up

To set up a bucket company, first you will need to revise the structure of your trust so that it can distribute any profits to the corporate beneficiary. You must sure you keep within the rules of the ATO to ensure you are compliant.

Distributing funds

If the owner of the trust elects to distribute funds to the bucket company for the financial year, a physical distribution for the same amount must be made to the company’s bank account prior to lodging the tax return.

Note: if there are insufficient funds, the ATO will grant a 7-year loan between the bucket company and trust, called a Div 7a loan.

A Div 7A loan has:

- A maximum term of 7 years

- A minimum annual repayment plan

- Interest that is payable at a government-prescribed rate

The trust must physically make payment to the bucket company each year, meeting minimum repayments. However, it may be possible for bucket companies to declare dividends that can be off-set against minimum repayment obligations.

Getting the money out

The most efficient way possible to get the money out is for shareholders to be paid in dividends. The shareholder would then receive a franking credit on the tax already paid, as the dividend had been taxed at the corporate rate.

Who should hold the company shares

It is important to establish your intention with who should be put in as a shareholder of the bucket company.

If they are individuals, this does not allow much flexibility in how the dividends are distributed. The dividends must be distributed exactly according to the shareholder percentage of the bucket company.

A smart way of getting around this is to set up a separate trust as the shareholder of the company. That way the trust can distribute dividends in the most tax effective way.

Example of tax-efficient distribution of funds using a bucket company strategy.

Tax tax tax

A bucket company can be a very good structure to hold long-term investments. The way in which companies are taxed is important to consider. For example, companies are not eligible for a 50% capital gains tax discount after 12 months of holding.

If you have distributed to a company to save tax, it is likely this will still be under your own personal tax rate. This is where a good financial advisor can show you how to create a tax minimisation strategy best suited to your situation.

Where to learn more about tax minimisation

The team at Endorphin Wealth have both the experience and knowledge to help keep your tax liability to a minimum.

For an obligation-free conversation about your financial future, please contact us on 03 9190 8964 or at [email protected].

The advisors at Endorphin Wealth are passionate about helping people achieve their life goals with great financial planning. We are not licensed or owned by the big banks and financial institutions, so the advice and solutions we provide is always in our client’s best interests. We have the advantage of being able to access a range of products from different providers to ensure that our clients’ needs are our primary focus. Our offices are located in Sydney and Melbourne, where you can find a financial advisor suitable for you.