Turning on the news at night may have your head spinning with the different opinions and insight into the rising interest rate environment.

Should you fix your home loan? Should you wait to see what happens in the next few months? How will the changes impact your cashflow?

There are lots of questions that you may have when you hear the news. At Endorphin Wealth we are here for those questions. Rising rates is not all bad news, and we can provide you with insight into the impact rising rates will have on you.

RBA Increases Official Cash Rate

Last week, the Reserve Bank of Australia increased the official cash rate by 50 basis poi9nts to 1.85 per cent. This is the fourth month in a row that the RBA have decided that a rise is important.

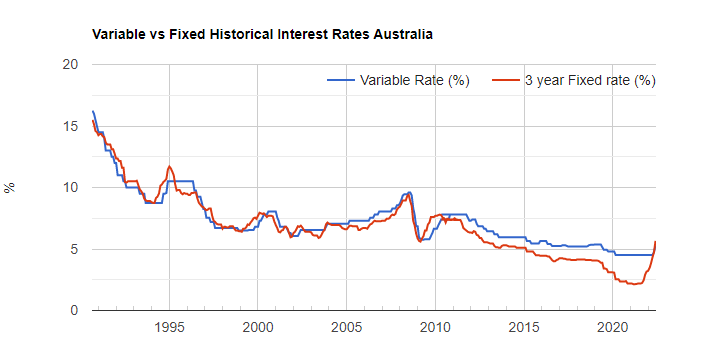

In the early 90’s, interest rates were as high as 17%. However, over time, we have seen these steadily decline to under under 3% in the last few years. With inflation increasing, the RBA have begun to rise rates again, bringing them above their record low rates in the previous years.

Why is the RBA Increasing Interest Rates?

Inflation is peaking its head through the clouds and you may be feeling the pinch at the supermarket, petrol station or local restaurant. The cost of living has been increasing steadily, with reports showing that the inflation rate at 6.1% in the June quarter. When compared to the RBA’s target inflation rate of 2-3%, this is quite substantial.

A simple way for the RBA to combat and help slow the increasing rate of inflation, is to increase the official cash rate, which is then passed on to mortgage holders through rising interest rates. Increasing rates, can help damper household spending, reducing discretionary income we have to go spend. In turn, this attempts to reduce the rate of inflation.

What does it mean for you?

Higher interest rates will push the minimum repayments on your loans upward, forcing additional repayments each month on your mortgage. This can make cashflow much tighter and may mean you have less income to use for discretionary spending. You may be finding yourself asking questions like ‘can we still afford going out for dinner every week?’ Or ‘is the holiday still possible for next year?’

If your repayments are getting too high and you are concerned about your cashflow, there are options available to you. Working closely with your financial advisor and mortgage broker, can help you find a path which suits you.

How can we help?

A trusted Financial Advisor can help you with your budgeting and cashflow management. Having a good grasp on your budget is the start of many great things.

If you have a good grip on your cashflow and budgeting, a Financial Advisor could help you with property decisions. Is now a good time to sell and buy property? With many getting scared of the rising rate environment, an Advisor can guide you down the right path. Most importantly, an Advisor will understand your cashflow and risk tolerance to determine what course of action you should take.

Always remember, a trusted Financial Advisor is here to help. From cashflow management to investment decisions, to insight into the property market, our Advisors can devise a plan which suits your personal situation.

If you have any questions, please reach out to the team for an obligation free discussion on 03 9190 8964 or [email protected]